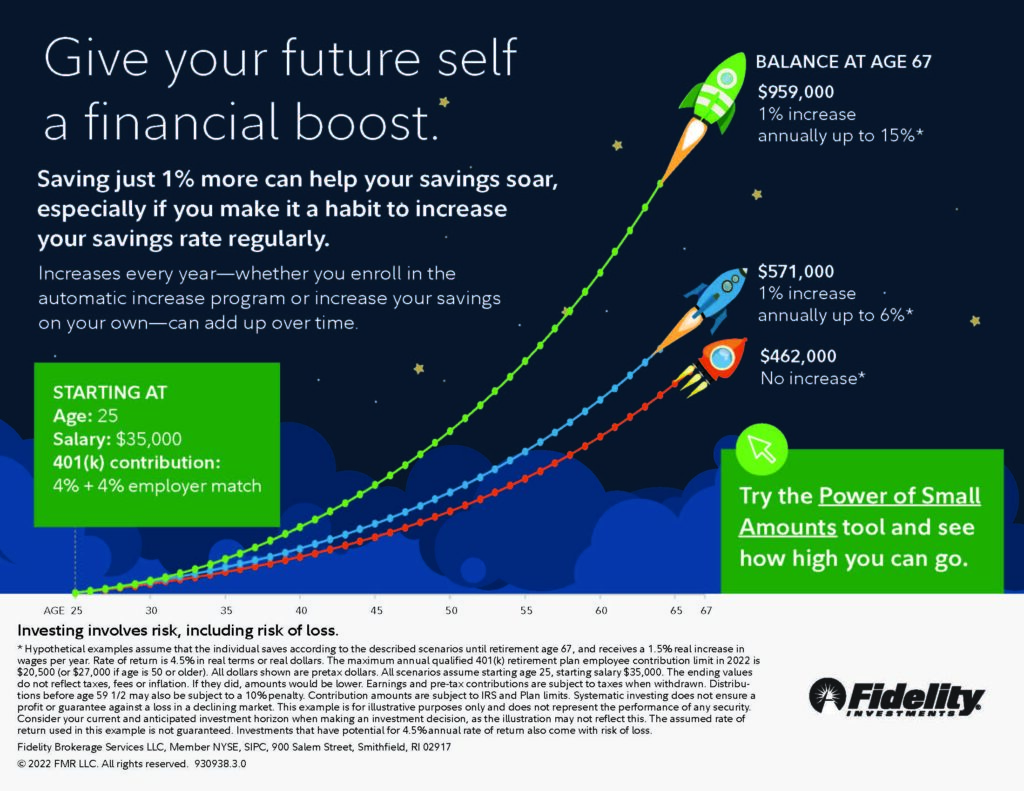

An extra 1% today could result in a more comfortable retirement tomorrow.

Give your future self a financial boost.

Maximize your 401(k) savings by contributing enough to receive the Lennox Company-paid match, which is essentially FREE money towards your retirement.

How much should you be saving?

Each person’s financial journey is different. The key is to find a balance that works for you – whether that means putting away an extra $10 or $100 every month.

Keep these factors in mind as you budget your per paycheck 401(k) contribution…

- Your target retirement age,

- Your current financial situation, and

- Your career and lifestyle changes.

Use Fidelity’s Power of Small Amounts Tool to maximize your money match.

Think of planning for retirement as a journey.

Setting up a 401(k) investment strategy is the next step in growing your retirement nest egg. It can give you tax breaks and boost your total earnings over time.

Remember, taking care of your finances will be a lot easier if you have a Fidelity financial professional on your side. Make an appointment today for a FREE confidential 1-on-1 consultation:

- Call Fidelity directly at (877) 902-0007,

- Visit a local Fidelity Investor Center, or

- Attend a Fidelity-hosted onsite workshop at Lennox.